Another one bites the dust....

Moderators: Coyote, nebugeater, Brad, Omaha Cowboy, BRoss

-

NovakOmaha

- Planning Board

- Posts: 2748

- Joined: Wed Sep 08, 2004 3:00 pm

- Location: Metro Detroit Michigan

Another one bites the dust....

June 14, 2005

BancWest Corporation Announces Acquisition of Commercial Federal Corporation by Bank of the West

(SAN FRANCISCO, Calif. and OMAHA, Neb., June 13, 2005) -- BancWest Corporation announced today that its Bank of the West subsidiary has signed a definitive agreement to acquire Commercial Federal Corporation (NYSE: CFB). In a cash transaction valued at $1.36 billion, Bank of the West will pay $34 for each Commercial Federal share, with a special 50-cent-per-share dividend paid at closing.

Omaha-based Commercial Federal is the parent company of Commercial Federal Bank, the nation’s 12th-largest thrift, which operates 198 branches in seven states in the Midwest, Colorado and Arizona. As of March 31, 2005, Commercial Federal Corporation had total assets of $10.4 billion, deposits of $6.5 billion and loans of $7.8 billion. In 2004, the company earned $76.4 million.

BancWest Corporation, whose principal subsidiaries are Bank of the West and First Hawaiian Bank, is the seventh largest bank holding company operating in the Western United States with assets of $51.4 billion. BancWest is a wholly owned subsidiary of BNP Paribas, which has previously announced plans to increase its retail banking presence in the Western United States. The transaction solidifies BancWest’s position in the Midwest and adds significant market share in several major metropolitan areas.

After the deal closes, Commercial Federal branches will become part of San Francisco-based Bank of the West, which will be the third largest commercial bank headquartered west of the Mississippi River. The acquisition will add three new states (Missouri, Oklahoma and Kansas) to BancWest’s branch footprint. Following the acquisition, BancWest will have approximately $64 billion in assets and serve more than 4 million customer accounts through 739 locations in 20 states.

"Commercial Federal’s service-oriented philosophy is a perfect match for Bank of the West. It’s a logical extension of Bank of the West’s expansion into the Midwest begun with last year’s acquisition of Community First Bancshares,” said BancWest President and Chief Executive Officer Don J. McGrath.

“Commercial Federal operates in high-growth retail markets that complement our existing footprint and provide us with opportunities for additional fill-in acquisitions. We’ll add dramatically to our market share in Denver – we’ll have nearly 100 Colorado branches. We will also become one of the leading banks in Omaha and Des Moines.

“Although the sign on the door will change, Commercial Federal customers will find the same familiar faces in their branches. And they’ll receive the same personal service they expect, because that’s been a Bank of the West tradition since 1874,” said McGrath, who is also Chairman and Chief Executive Officer of Bank of the West.

“Commercial Federal has already begun to make a transition from a traditional thrift to a commercial bank, and we see opportunities as we continue along that path to offer a broader array of business banking and consumer products,” McGrath said.

William Fitzgerald, Commercial Federal Chairman and Chief Executive Officer, said: “This merger offers a compelling value for our shareholders and provides an opportunity for our employees to join another strong and caring company that is growing rapidly. Our customers will have access to a wider selection of products and services in consumer and commercial banking, investments and insurance. I know Bank of the West has the same commitment that we have to supporting the communities where they do business. We’re pleased that this tradition of community support will continue here in Omaha and everywhere Commercial Federal operates.”

The purchase price represents 1.8 times book value, 14.8 times consensus 2006 earnings and a 27 percent premium to the average closing price of Commercial Federal stock over the past six months.

The boards of directors of BNP Paribas, BancWest Corporation and Commercial Federal Corporation have approved the transaction. The merger requires approval from Commercial Federal shareholders and federal and state banking regulators. Once all approvals have been received, the merger is expected to close in the fourth quarter of this year.

(more)

BancWest’s track record – 15 acquisitions across 17 states since 1990 – demonstrates its ability to manage integrations seamlessly, McGrath said. Its most recent acquisitions were the 2002 purchase of United California Bank ($10.5 billion assets, 115 branches in California) and last year’s purchase of Community First Bancshares ($5.5 billion assets, 166 locations in 12 states) and USDB Bancorp ($1.2 billion assets, 19 California branches).

“With each acquisition, we’ve added assets and customers and improved our operating efficiency,” McGrath added.

About Commercial Federal Corporation

Commercial Federal Corporation (NYSE:CFB) is the parent company of Commercial Federal Bank (http://www.comfedbank.com), a $10.4-billion federal savings bank founded in Omaha in 1887. It has 198 branches in Nebraska, Iowa, Colorado, Kansas, Oklahoma, Missouri and Arizona. Commercial Federal operations include consumer and commercial banking services, including retail banking, commercial and industrial lending, small business banking, construction lending, cash management, and insurance and investment services.

About Bank of the West

Bank of the West (http://www.bankofthewest.com), which is based in San Francisco, has $41.0 billion in assets. It has 480 banking locations in 16 Western and Midwestern states: California, Oregon, Washington, Idaho, Nevada, Utah, Arizona, New Mexico, Colorado, Wyoming, Nebraska, North and South Dakota, Minnesota, Iowa and Wisconsin. Founded in San Jose, California in 1874 as Farmers National Gold Bank, Bank of the West is the fourth-largest commercial bank headquartered west of the Mississippi.

About BancWest

BancWest Corporation (http://www.bancwestcorp.com) is a bank holding company with assets of $51.4 billion and headquarters offices in Honolulu, Hawaii, and San Francisco, California. Besides Bank of the West, BancWest’s other principal subsidiary First Hawaiian Bank (56 branches in Hawaii, three in Guam and two in Saipan). BancWest is a wholly owned subsidiary of BNP Paribas (http://www.bnpparibas.com), a European leader in banking and financial services, with a significant and growing presence in the United Sates and leading positions in Asia. The most profitable bank in the Euro zone, it has a presence in over 85 countries with close to 100,000 employees.

This release contains forward-looking statements, including statements regarding anticipated timing of the transaction and possible performance of the combined company after the transaction is completed. Such statements reflect management's best judgment as of this date, but they involve risks and uncertainties that could cause actual results to differ materially from those presented. Factors that could cause such differences include, without limitation: (1) the possibility that regulatory approvals may be delayed or denied or that burdensome conditions may be imposed in connection with such approvals; (2) the possibility of customer or employee attrition following this transaction; (3) failure to fully realize expected cost savings from the transaction; (4) lower than expected revenues following the transaction; (5) problems or delays in bringing together the two companies; (6) the possibility of adverse changes in global, national or local economic or monetary conditions, (7) competition and change in the financial services business, and (8) other factors described in our recent filings with the Securities and Exchange Commission. Those factors or others could result, for example, in delay or termination of the transaction discussed above. Readers should carefully consider those risks and uncertainties in reading this release. Except as otherwise required by law, BancWest and Commercial Federal Corporation disclaim any obligation to update any forward-looking statements included herein to reflect future events or developments.

In connection with the proposed transaction, Commercial Federal will be filing proxy statements and other materials with the Securities and Exchange Commission. Investors are urged to read the proxy statement and these materials when they are available because they contain important information.

Commercial Federal and its officers and directors may be deemed to be participants in the solicitation of proxies with respect to the proposed transaction matters. Information regarding such individuals is included in Commercial Federal’s proxy statements and Annual Reports on Form 10-K previously filed with the Securities and Exchange Commission, and in the proxy statement relating to the merger when it becomes available. Investors may obtain a free copy of the proxy statements and other relevant documents when they become available as well as other materials filed with the Securities and Exchange Commission concerning Commercial Federal and these individuals at the Securities and Exchange Commission's website at http://www.sec.gov. These materials and other documents may also be obtained for free from Commercial Federal Corporation by sending an e-mail to investorrelations@commercialfed.com.

BancWest Corporation Announces Acquisition of Commercial Federal Corporation by Bank of the West

(SAN FRANCISCO, Calif. and OMAHA, Neb., June 13, 2005) -- BancWest Corporation announced today that its Bank of the West subsidiary has signed a definitive agreement to acquire Commercial Federal Corporation (NYSE: CFB). In a cash transaction valued at $1.36 billion, Bank of the West will pay $34 for each Commercial Federal share, with a special 50-cent-per-share dividend paid at closing.

Omaha-based Commercial Federal is the parent company of Commercial Federal Bank, the nation’s 12th-largest thrift, which operates 198 branches in seven states in the Midwest, Colorado and Arizona. As of March 31, 2005, Commercial Federal Corporation had total assets of $10.4 billion, deposits of $6.5 billion and loans of $7.8 billion. In 2004, the company earned $76.4 million.

BancWest Corporation, whose principal subsidiaries are Bank of the West and First Hawaiian Bank, is the seventh largest bank holding company operating in the Western United States with assets of $51.4 billion. BancWest is a wholly owned subsidiary of BNP Paribas, which has previously announced plans to increase its retail banking presence in the Western United States. The transaction solidifies BancWest’s position in the Midwest and adds significant market share in several major metropolitan areas.

After the deal closes, Commercial Federal branches will become part of San Francisco-based Bank of the West, which will be the third largest commercial bank headquartered west of the Mississippi River. The acquisition will add three new states (Missouri, Oklahoma and Kansas) to BancWest’s branch footprint. Following the acquisition, BancWest will have approximately $64 billion in assets and serve more than 4 million customer accounts through 739 locations in 20 states.

"Commercial Federal’s service-oriented philosophy is a perfect match for Bank of the West. It’s a logical extension of Bank of the West’s expansion into the Midwest begun with last year’s acquisition of Community First Bancshares,” said BancWest President and Chief Executive Officer Don J. McGrath.

“Commercial Federal operates in high-growth retail markets that complement our existing footprint and provide us with opportunities for additional fill-in acquisitions. We’ll add dramatically to our market share in Denver – we’ll have nearly 100 Colorado branches. We will also become one of the leading banks in Omaha and Des Moines.

“Although the sign on the door will change, Commercial Federal customers will find the same familiar faces in their branches. And they’ll receive the same personal service they expect, because that’s been a Bank of the West tradition since 1874,” said McGrath, who is also Chairman and Chief Executive Officer of Bank of the West.

“Commercial Federal has already begun to make a transition from a traditional thrift to a commercial bank, and we see opportunities as we continue along that path to offer a broader array of business banking and consumer products,” McGrath said.

William Fitzgerald, Commercial Federal Chairman and Chief Executive Officer, said: “This merger offers a compelling value for our shareholders and provides an opportunity for our employees to join another strong and caring company that is growing rapidly. Our customers will have access to a wider selection of products and services in consumer and commercial banking, investments and insurance. I know Bank of the West has the same commitment that we have to supporting the communities where they do business. We’re pleased that this tradition of community support will continue here in Omaha and everywhere Commercial Federal operates.”

The purchase price represents 1.8 times book value, 14.8 times consensus 2006 earnings and a 27 percent premium to the average closing price of Commercial Federal stock over the past six months.

The boards of directors of BNP Paribas, BancWest Corporation and Commercial Federal Corporation have approved the transaction. The merger requires approval from Commercial Federal shareholders and federal and state banking regulators. Once all approvals have been received, the merger is expected to close in the fourth quarter of this year.

(more)

BancWest’s track record – 15 acquisitions across 17 states since 1990 – demonstrates its ability to manage integrations seamlessly, McGrath said. Its most recent acquisitions were the 2002 purchase of United California Bank ($10.5 billion assets, 115 branches in California) and last year’s purchase of Community First Bancshares ($5.5 billion assets, 166 locations in 12 states) and USDB Bancorp ($1.2 billion assets, 19 California branches).

“With each acquisition, we’ve added assets and customers and improved our operating efficiency,” McGrath added.

About Commercial Federal Corporation

Commercial Federal Corporation (NYSE:CFB) is the parent company of Commercial Federal Bank (http://www.comfedbank.com), a $10.4-billion federal savings bank founded in Omaha in 1887. It has 198 branches in Nebraska, Iowa, Colorado, Kansas, Oklahoma, Missouri and Arizona. Commercial Federal operations include consumer and commercial banking services, including retail banking, commercial and industrial lending, small business banking, construction lending, cash management, and insurance and investment services.

About Bank of the West

Bank of the West (http://www.bankofthewest.com), which is based in San Francisco, has $41.0 billion in assets. It has 480 banking locations in 16 Western and Midwestern states: California, Oregon, Washington, Idaho, Nevada, Utah, Arizona, New Mexico, Colorado, Wyoming, Nebraska, North and South Dakota, Minnesota, Iowa and Wisconsin. Founded in San Jose, California in 1874 as Farmers National Gold Bank, Bank of the West is the fourth-largest commercial bank headquartered west of the Mississippi.

About BancWest

BancWest Corporation (http://www.bancwestcorp.com) is a bank holding company with assets of $51.4 billion and headquarters offices in Honolulu, Hawaii, and San Francisco, California. Besides Bank of the West, BancWest’s other principal subsidiary First Hawaiian Bank (56 branches in Hawaii, three in Guam and two in Saipan). BancWest is a wholly owned subsidiary of BNP Paribas (http://www.bnpparibas.com), a European leader in banking and financial services, with a significant and growing presence in the United Sates and leading positions in Asia. The most profitable bank in the Euro zone, it has a presence in over 85 countries with close to 100,000 employees.

This release contains forward-looking statements, including statements regarding anticipated timing of the transaction and possible performance of the combined company after the transaction is completed. Such statements reflect management's best judgment as of this date, but they involve risks and uncertainties that could cause actual results to differ materially from those presented. Factors that could cause such differences include, without limitation: (1) the possibility that regulatory approvals may be delayed or denied or that burdensome conditions may be imposed in connection with such approvals; (2) the possibility of customer or employee attrition following this transaction; (3) failure to fully realize expected cost savings from the transaction; (4) lower than expected revenues following the transaction; (5) problems or delays in bringing together the two companies; (6) the possibility of adverse changes in global, national or local economic or monetary conditions, (7) competition and change in the financial services business, and (8) other factors described in our recent filings with the Securities and Exchange Commission. Those factors or others could result, for example, in delay or termination of the transaction discussed above. Readers should carefully consider those risks and uncertainties in reading this release. Except as otherwise required by law, BancWest and Commercial Federal Corporation disclaim any obligation to update any forward-looking statements included herein to reflect future events or developments.

In connection with the proposed transaction, Commercial Federal will be filing proxy statements and other materials with the Securities and Exchange Commission. Investors are urged to read the proxy statement and these materials when they are available because they contain important information.

Commercial Federal and its officers and directors may be deemed to be participants in the solicitation of proxies with respect to the proposed transaction matters. Information regarding such individuals is included in Commercial Federal’s proxy statements and Annual Reports on Form 10-K previously filed with the Securities and Exchange Commission, and in the proxy statement relating to the merger when it becomes available. Investors may obtain a free copy of the proxy statements and other relevant documents when they become available as well as other materials filed with the Securities and Exchange Commission concerning Commercial Federal and these individuals at the Securities and Exchange Commission's website at http://www.sec.gov. These materials and other documents may also be obtained for free from Commercial Federal Corporation by sending an e-mail to investorrelations@commercialfed.com.

-

NovakOmaha

- Planning Board

- Posts: 2748

- Joined: Wed Sep 08, 2004 3:00 pm

- Location: Metro Detroit Michigan

Yeah, and I wouldn't look for a Bank of the West Tower in downtown Omaha any time soon.

The only city I ever heard of that actually did better after a buyout was Des Moines with Wells Fargo, who seems to be moving an entire city there.

I am a bit curious what will become of the new CFB buildings in west Omaha. Perhaps a large call center, with jobs paying over $7 per hour?

This has been coming for some time. There is a large shareholder who has been crying the blues about the stock price for a long time. Got his wish.

The only city I ever heard of that actually did better after a buyout was Des Moines with Wells Fargo, who seems to be moving an entire city there.

I am a bit curious what will become of the new CFB buildings in west Omaha. Perhaps a large call center, with jobs paying over $7 per hour?

This has been coming for some time. There is a large shareholder who has been crying the blues about the stock price for a long time. Got his wish.

<<<<

“Commercial Federal operates in high-growth retail markets that complement our existing footprint and provide us with opportunities for additional fill-in acquisitions. We’ll add dramatically to our market share in Denver – we’ll have nearly 100 Colorado branches. We will also become one of the leading banks in Omaha and Des Moines.

>>>>

Nice to be mentioned in that context.

It really doesn't sound like they'll be doing much more than changing the sign on the door, ala Wells Fargo/Norwest.

I suppose there could be some job fallout as upper-management is consolidated, but these things usually don't decimate the workforce, white or blue collar.

-Big E

“Commercial Federal operates in high-growth retail markets that complement our existing footprint and provide us with opportunities for additional fill-in acquisitions. We’ll add dramatically to our market share in Denver – we’ll have nearly 100 Colorado branches. We will also become one of the leading banks in Omaha and Des Moines.

>>>>

Nice to be mentioned in that context.

It really doesn't sound like they'll be doing much more than changing the sign on the door, ala Wells Fargo/Norwest.

I suppose there could be some job fallout as upper-management is consolidated, but these things usually don't decimate the workforce, white or blue collar.

-Big E

Stable genius.

-

NovakOmaha

- Planning Board

- Posts: 2748

- Joined: Wed Sep 08, 2004 3:00 pm

- Location: Metro Detroit Michigan

By the way, I noticed that in the middle of the "forward looking statements" notice near the bottom of the release the board put a smiley where the "left paren 8" is. I bet they didnt plan on a smiley in the release.

Another thing. It is now 8:45AM and the OWH hasn't picked it up? I first saw it on the Lincoln Journal site. It's on bizweb & most other business sites. Even on AOL. Gee, and I thought that the Local Monopoly Fishwrap was state of the art....tsk, tsk.

Another thing. It is now 8:45AM and the OWH hasn't picked it up? I first saw it on the Lincoln Journal site. It's on bizweb & most other business sites. Even on AOL. Gee, and I thought that the Local Monopoly Fishwrap was state of the art....tsk, tsk.

(That's just the result of the forum 'software' interpreting the press release text inserted here Novak)

Wow... this came out of nowhere. They're busy working on their third building out there at 132nd. This has got to mean a significant loss of jobs I would assume.

So I wonder if they'll axe the big annual Memorial Park concert and fireworks show too??

Wow... this came out of nowhere. They're busy working on their third building out there at 132nd. This has got to mean a significant loss of jobs I would assume.

So I wonder if they'll axe the big annual Memorial Park concert and fireworks show too??

-

DMRyan

- Human Relations

- Posts: 645

- Joined: Sun Feb 08, 2004 8:07 pm

- Location: Des Moines, IA

- Contact:

I guess I'm not understanding where the presumed loss of jobs will come into play, save for some upper management types that may no longer be needed.

I would think they would still need a sizable workforce for their midwest operations, and what better place than Omaha: where they currently have offices and a huge presence?

While one of Omaha's own got plucked away with this, it's too early to tell what's going to happen with job cuts and such.

I would think they would still need a sizable workforce for their midwest operations, and what better place than Omaha: where they currently have offices and a huge presence?

While one of Omaha's own got plucked away with this, it's too early to tell what's going to happen with job cuts and such.

DesMoines Forum: https://urbandsm.com/forum/

- Omaha Cowboy

- The Don

- Posts: 1013189

- Joined: Wed Jan 07, 2004 5:31 am

- Location: West Omaha

I agree with you Ryan..

Naturally the first reaction to news like this is 'the sky is falling'..

Lets see how it shakes out over the next several months..

Also lets not assume any loss of jobs..Maybe in fact, there could be a plus factor involved in this as it relates to jobs..This may not be as bad as many think..

..Ciao..LiO....Peace

Naturally the first reaction to news like this is 'the sky is falling'..

Lets see how it shakes out over the next several months..

Also lets not assume any loss of jobs..Maybe in fact, there could be a plus factor involved in this as it relates to jobs..This may not be as bad as many think..

..Ciao..LiO....Peace

Go Cowboys!

- Omaha Cowboy

- The Don

- Posts: 1013189

- Joined: Wed Jan 07, 2004 5:31 am

- Location: West Omaha

From the W-H piece:

'A San Francisco bank that is part of France's second-largest bank has offered to buy Commercial Federal Corp., Nebraska's largest banking company, in a transaction that could cost Omaha 830 administrative and back-office jobs as well as a corporate headquarters.'..

Expected. Remember the word is 'could' not 'will' as it relates to jobs..Naturally the Weird-Herald must lead off with this in it's first paragraph..Let the FEAR begin..Undoubtably many of it's readers will perceive job loss as a 'for sure thing' after digesting this..But..Oh well..

The complete link to the W-H piece:

http://www.omaha.com/index.php?u_pg=46& ... nd=4658172

..Ciao..LiO....Peace

'A San Francisco bank that is part of France's second-largest bank has offered to buy Commercial Federal Corp., Nebraska's largest banking company, in a transaction that could cost Omaha 830 administrative and back-office jobs as well as a corporate headquarters.'..

Expected. Remember the word is 'could' not 'will' as it relates to jobs..Naturally the Weird-Herald must lead off with this in it's first paragraph..Let the FEAR begin..Undoubtably many of it's readers will perceive job loss as a 'for sure thing' after digesting this..But..Oh well..

The complete link to the W-H piece:

http://www.omaha.com/index.php?u_pg=46& ... nd=4658172

..Ciao..LiO....Peace

Last edited by Omaha Cowboy on Tue Jun 14, 2005 11:10 am, edited 2 times in total.

Go Cowboys!

- Omaha Cowboy

- The Don

- Posts: 1013189

- Joined: Wed Jan 07, 2004 5:31 am

- Location: West Omaha

-

NovakOmaha

- Planning Board

- Posts: 2748

- Joined: Wed Sep 08, 2004 3:00 pm

- Location: Metro Detroit Michigan

Yeah. I read it. I think the thing that comes to mind, Cowboy, is that the jobs & corp office would be the first thing that people would think of . And while I can't believe that I'm semi-defending the local monopoly fishwrap, the piece does define the numbers.

To the uninformed reader, if the piece didn't lead with the 830 figure they could assume that there thousands of jobs.

Having said all that, I still can't believe that the Local Monopoly Fishwrap got scooped by pretty much every news organization, including TV Guide.

To the uninformed reader, if the piece didn't lead with the 830 figure they could assume that there thousands of jobs.

Having said all that, I still can't believe that the Local Monopoly Fishwrap got scooped by pretty much every news organization, including TV Guide.

- Omaha Cowboy

- The Don

- Posts: 1013189

- Joined: Wed Jan 07, 2004 5:31 am

- Location: West Omaha

-

DMRyan

- Human Relations

- Posts: 645

- Joined: Sun Feb 08, 2004 8:07 pm

- Location: Des Moines, IA

- Contact:

Anything is possible, but I can't imagine moving 850 jobs from Omaha when it's already the hub for a large bank that has just been acquired.

DesMoines Forum: https://urbandsm.com/forum/

-

Minneapolis Boy

- Library Board

- Posts: 343

- Joined: Mon Feb 09, 2004 2:31 pm

- Location: Back in Omaha!

-

OmahaDevelopmentMan

- Human Relations

- Posts: 595

- Joined: Tue Nov 09, 2004 6:12 pm

- Location: Omaha, someplace in middle America

Dang, there went the Comercial Federal DT tower dream....maybe...

I'd bet with a couple new state of the art headquarters buildings underway/completed, that would help Omaha's case to keep some jobs here. Hopefully the chamber will work hard to keep significant operations here like the Ameritrade deal if it is to fall through.

I'd bet with a couple new state of the art headquarters buildings underway/completed, that would help Omaha's case to keep some jobs here. Hopefully the chamber will work hard to keep significant operations here like the Ameritrade deal if it is to fall through.

- Coyote

- City Council

- Posts: 33293

- Joined: Tue Nov 18, 2003 11:18 am

- Location: Aksarben Village

- Contact:

Motley Fools take:

Grow East, BancWest

Grow East, BancWest

Motley Fool wrote:Although I suppose I should feel a little nostalgic at seeing such an old bank (it was founded in 1887) headquartered in my hometown going away, I don't. Commercial Federal had been performing poorly of late -- returns on capital and margins were both pretty feeble over the past few years and were seldom ever what I'd call "stellar." This buyout does at least give investors the opportunity to cash out at a pretty good price and move on.

- UNOstudent

- Human Relations

- Posts: 584

- Joined: Sun Nov 07, 2004 10:27 pm

well im a teller at cfb and think overall it wont affect much. the jobs at the all branches will be secure, but some of the back office jobs may be on thin ice. i read in a statement sent to cfb employees that omaha will serve as a midwest regional office, largely due to the new buildings, so that should keep most of the jobs. like someone mentioned earlier, most things will stay the same and bank of the west will be signing my checks instead of cfb. as far as i know, bank of the west will continue the 4th of july fireworks/concert. the official change is supposed to be december 1st, assuming it approved.

Buyout of Com Fed conforms to pattern

Buyout of Com Fed conforms to pattern

http://www.omaha.com/index.php?u_pg=46&u_sid=1436404

http://www.omaha.com/index.php?u_pg=46&u_sid=1436404

Bank of the West Chief Executive Don McGrath made a point Tuesday of saying that the bank would continue to sponsor the annual Fourth of July concerts and fireworks that Commercial Federal began years ago in Omaha.

Omaha Skyline Photos, Omaha Aerial Photos, and More.

Website: www.bradwilliamsphotography.com

Facebook: www.facebook.com/bradwilliamsphotography

Twitter: www.twitter.com/bradwphoto

Instagram: www.instagram.com/bradwilliamsphotography

YouTube: www.youtube.com/@bradwilliamsphoto

It might not be that bad......

Bank of the West, Commercial Federal work out details

Bank of the West, Commercial Federal work out details

Bank of the West hopes to save $84 million in operating costs over two years after it buys Commercial Federal Corp. of Omaha, partly by moving some operations to lower-cost Omaha offices.

On the day he made the merger plan public, Bank of the West CEO Don J. McGrath announced that Omaha would become the home of the combined bank's mortgage lending operation because of Commercial Federal's highly developed mortgage loan operation.

John Stafford, a Bank of the West spokesman, said the transition team is looking at other operations that could be combined in Omaha, where salaries, office space and other costs are attractive.

"There are definitely going to be some additional business lines staffing up in Omaha," Stafford said, but the decisions are still "up in the air." Those offices would keep some current Commercial Federal employees and could bring others to Omaha from California.

Bank of the West wants, as much as possible, to keep Commercial Federal employees and use Commercial Federal's new office buildings near 132nd Street and West Dodge Road, which house its back-office functions, he said.

- Omaha Cowboy

- The Don

- Posts: 1013189

- Joined: Wed Jan 07, 2004 5:31 am

- Location: West Omaha

- UNOstudent

- Human Relations

- Posts: 584

- Joined: Sun Nov 07, 2004 10:27 pm

- nativeomahan

- County Board

- Posts: 5366

- Joined: Fri Nov 12, 2004 2:46 pm

- Location: Omaha and Puerto Vallarta

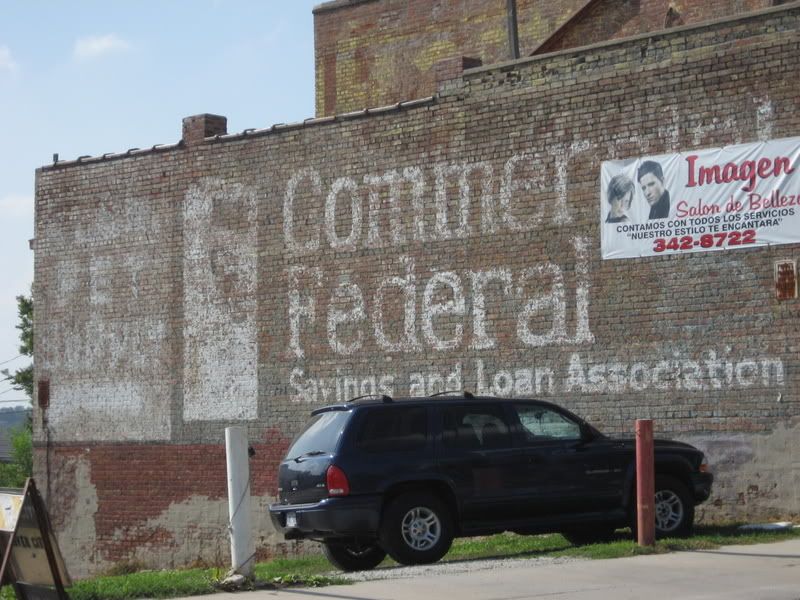

I agree - and actually, this sign and others downtown are probably pushing 50, 75 & 100+ years! Of course, if they're 100 years old, they're probably asbestos, lead and every other chemical known to man that they ban the use of.nativeomahan wrote:Why is it that a sign painted on the brick side of a building can last 20 years but the lane striping done on Omaha streets seems to disappear in 2 months? See if you can locate the stripes near 90th and W. Center.

But, the streets get so screwed up due to traffic (of course) and our brutal winters - the sand, salt & all that other crud messes it up. I think we should go to embedded LEDs within the pavement that last over 10 years, and won't break

D

- UNOstudent

- Human Relations

- Posts: 584

- Joined: Sun Nov 07, 2004 10:27 pm

- nativeomahan

- County Board

- Posts: 5366

- Joined: Fri Nov 12, 2004 2:46 pm

- Location: Omaha and Puerto Vallarta

...except, we haven't had salt or sand on the streets in 5 or 6 months. Â I don't think that can be used as an excuse in August! Â The city just doesn't care if motorists can figure out where the lanes are. Â And the 90th and W. Center intersection is particularly bizarrely designed on the south side, so that if southbound traffic proceeds straight through the intersection you end up completely on the wrong side of the road. Â Without lane stripes or signs I am surprised there haven't been more accidents there. Â This issue is one of my pet peeves. Â I travel extensively and don't see this problem in any other city, even in MPLS where the winters are much worse than ours.djc311 wrote:I agree - and actually, this sign and others downtown are probably pushing 50, 75 & 100+ years! Of course, if they're 100 years old, they're probably asbestos, lead and every other chemical known to man that they ban the use of.nativeomahan wrote:Why is it that a sign painted on the brick side of a building can last 20 years but the lane striping done on Omaha streets seems to disappear in 2 months? See if you can locate the stripes near 90th and W. Center.

But, the streets get so screwed up due to traffic (of course) and our brutal winters - the sand, salt & all that other crud messes it up. I think we should go to embedded LEDs within the pavement that last over 10 years, and won't break

D